HerVest is an inclusive fintech for women. They provide easy access to target savings, impact investments, and credit financing for smallholder women farmers and women-owned/led SMEs in Nigeria.

They are committed to improving women’s lives through greater access to and use of financial services.

There is a $42bn gender finance gap in Africa, with over $15.6bn trapped in agriculture.

Lack of access to capital and other layers of financial services stunts women’s economic growth.

At HerVest, they are committed to improving women’s lives through greater access to financial services by leveraging technology for peer-to-peer capital reallocation.

Nigerian women account for 41% of micro-businesses in Nigeria. Yet they receive less than 15% of conventional business loans.

Therefore, they are switching the narrative by providing flexible loans and resources to female entrepreneurs to scale their businesses and achieve their financial goals.

Investors generate financial and social impact by providing low-interest financing for verified, credible smallholder female farmers in our cooperative networks in rural areas.

How it Works

Security

HerVest savings are placed with VFD Microfinance Bank. VFD Microfinance Bank is NDIC insured and regulated by the Central Bank of Nigeria (CBN).

Also, HerVest investments are insured by Royal Exchange General Insurance Company. They both ensure your money is protected and invested in secured options as promised.

Savings

HerVest users can create multiple savings plans while earning interest on the go.

Whether it’s towards your rent, emergency fund, education, a side hustle, business expansion, vacations, wedding expenses, or even retirement, enjoy the best returns to meet your goals.

A purse is a liquid savings account that allows you to access funds at any time on your HerVest app account.

A savings plan, on the other hand, helps you save money toward your mid or long-term financial goals.

Impact investments allow you to earn financial returns when you sponsor a female farmer by investing in specific agro crops.

To fund a savings plan, simply add a payment card or transfer from your purse balance.

You can set up your savings plan to be debited according to an amount or a specific time frame: daily, weekly, or monthly.

Add a payment card and edit your savings plan to begin smashing those financial goals.

A Cliq savings plan allows you to save towards life milestones with friends and family. This is a locked plan with a minimum duration of 3 months.

Earn up to 10% interest per annum when you save with your Cliq.

You can add as many people as you want using their unique HerVest account number.

The savings target will be evenly split amongst the members of the Cliq plan.

Withdrawals

The option to withdraw locked savings is only available once the plan has reached its maturity date.

This is to encourage financial discipline and help you meet any short – or long-term financial goals.

To withdraw from a matured investment plan, simply visit your investment section on the app and move your funds into your HerVest purse account.

Thereafter, you can proceed to withdraw directly into your bank account.

Loans

They give credit financing opportunities to only small-holder women farmers.

Payments

HerVest is completely free to use. Zero SMS fees, zero account maintenance fees, and zero administration fees.

However, Impact Investments incurs minimal processing charges from our payment partners.

To purchase agro-investment slots, simply add a payment card or pay from your HerVest purse account.

Referrals

You can refer your family, friends, or colleagues to use HerVest by simply sharing your referral code.

Once they sign up with your referral code and perform a transaction, either creating a savings plan or participating in impact investments, you earn your referral bonus.

Bank Verification Number (BVN)

The Bank Verification Number (BVN) is required to validate your identity and ensure the safety of your funds.

It also ensures a seamless transfer of funds on the app.

Founders

Solape Akinpelu

Solape Akinpelu is the CEO and Co-founder of HerVest. She is a Certified Financial Education Instructor and a member of the Personal Finance Speakers Association (USA).

Solape also doubles as the Chairman of Technology Group, Nigerian-British Chamber of Commerce, and Chapter Director for Women in Tech Nigeria, an international organization with a double mission: to close the gender gap and to help women embrace technology.

Solape is a member of the Chartered Institute of Marketing (UK) and has attended impactful executive programs at prestigious institutions including The Lagos Business School and INSEAD, France.

Her first book: Stripped: An African Woman’s Guide to Building Generational Wealth is widely celebrated for its actionable strategies that support African women in building and managing generational wealth.

As a global and sought-after speaker, she continues to lead gender finance conversations online, offline, in print, and across leading media publications.

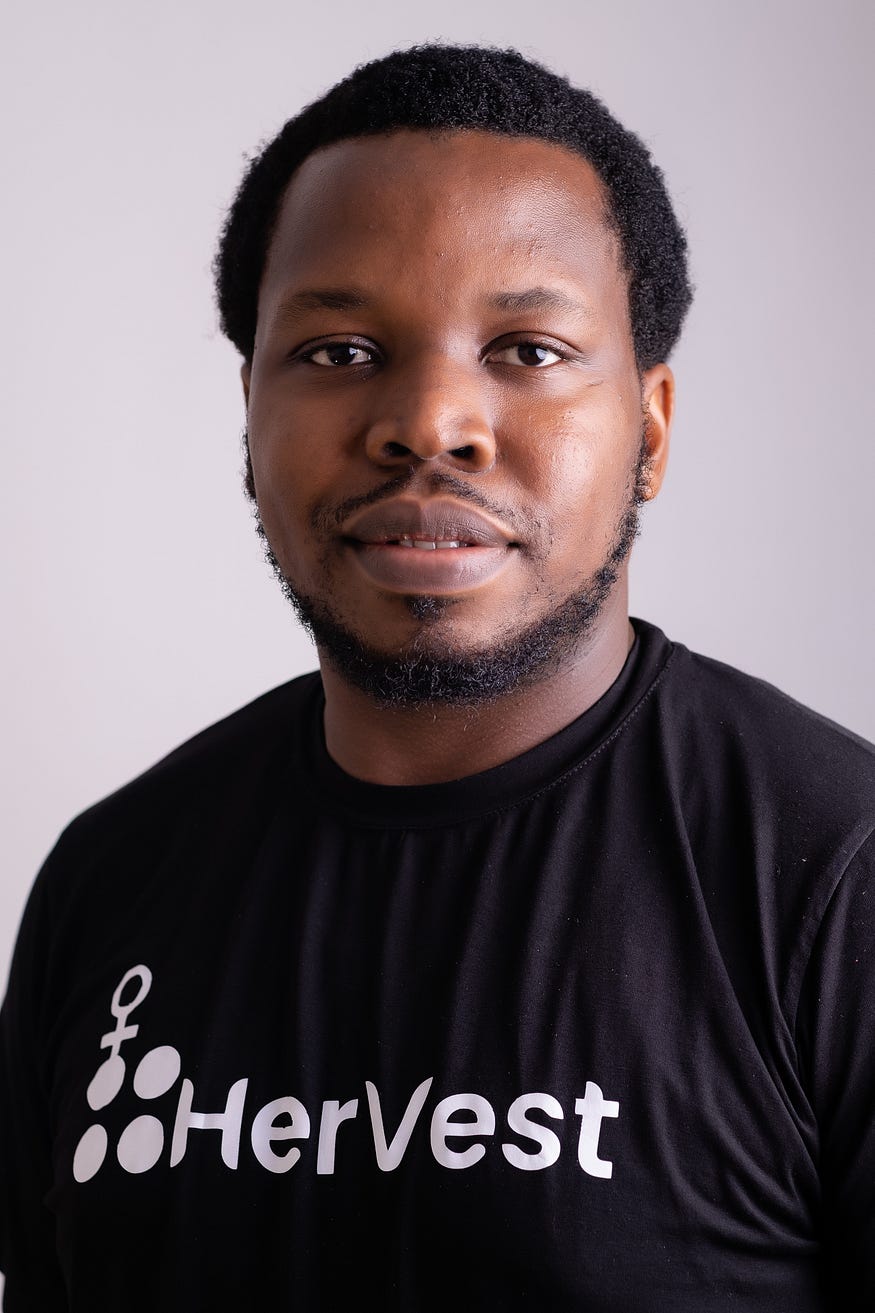

Yomi Ogunleye

Yomi Ogunleye is the Chief Technology Officer and Co-founder at HerVest.

He holds a Bachelor’s in Computer Science from the University of Stirling, United Kingdom.

Yomi is an experienced Software Engineering Professional with demonstrated skills in Core Programming, Database Management, Mobile Apps Development, Web Development, Customer Success, and Product Management.

Aside from his fascination with building innovative products, Yomi loves to read Sci-Fis. An avid trekker, he hopes to one day build his Starfleet Academy.

Investors & Funding Rounds

Angel investors

HerVest raised a friends and family funding round of $100,000.

The company plans to use the capital to add to its nine-person team, strengthen its digital infrastructure and accelerate marketing efforts.

It started operations as a distributed company and still mostly operates as one.

To get the word out, HerVest has relied on referrals and partnerships with cooperatives and social media.

The company has a live app on iOS and Android and recently launched a desktop application.

By investing in these women, HerVest aims to provide growth opportunities toward specific crops, grain banking, livestock, and the provision of digitized e-extension services to female small-scale farmers in rural areas.

Main Competitors

Perpay: This is an all-in-one FinTech app providing underserved consumers with an easy way to make purchases, pay over time, and build credit.

Hnry: It is a Fintech company that provides accounting and tax automation for freelancers and contractors in a single platform.

Lidya: This is a financial services platform to improve access to credit and finance across frontier and emerging markets starting with Nigeria.

Related:

Solar Sister: Story, Founders, Investors & Funding Rounds